Health insurers have released proposed double digit rate increases for upcoming 2017 year

Published 8:37 am Monday, May 16, 2016

- Health insurers have released proposed double digit rate increases for upcoming 2017 year

If health insurers get their way, most Oregonians who buy their own policies will pay significantly higher monthly premiums next year.

Rate proposals released Tuesday show nine of the 10 carriers selling individual policies — for people who buy for themselves and their families — want to increase rates by double digits. About 219,000 Oregonians were covered under individual policies at the end of 2015. Moda Health Plan, which almost left the individual market in February because of its dire financial state, wants the highest average increase: 32.3 percent. Oregon’s Health CO-OP is seeking the second highest at 32 percent.

Only one carrier, Health Net Health Plan of Oregon, wants to keep its average rates unchanged in 2017. Health Net is a small player in the individual market, with only 1,400 customers at the end of 2015. The state’s Division of Financial Regulation presents the rate requests as average increases or decreases across all policies carriers sell; some policies may see higher or lower fluctuations.

“The rates are a little bit of a dark cloud on the horizon, to say the least,” said Jesse Ellis O’Brien, policy director with the consumer advocacy group Oregon State Public Interest Research Group and OSPIRG Foundation. “We’re concerned about them.”

Higher premiums would result in higher tax credits in 2017. Currently, 71 percent of Oregonians with marketplace policies receive tax credits, according to the U.S. Department of Health and Human Services.

Officials with the state division will spend the next two months analyzing the rate requests to ensure they’re not too high or low.

Officials will issue preliminary rate decisions June 16, and final decisions will be released July 1.

Friday, the division will post detailed explanations from carriers on oregonhealthrates.org. The public is invited to visit the website and post comments, which will be accepted Friday through June 24.

“Our open process allows Oregonians to see everything we do and provide comments on the filings that affect them,” Oregon Insurance Commissioner Laura Cali wrote in a statement.

Oregon requires insurers to file rate proposals earlier than any other state, which means the proposals offer the first indication of how premiums could look nationwide in 2017. Some reports have predicted higher premiums nationwide next year.

The proposed increases, although high, are not as extreme as some of the initial proposals for 2016. Time Insurance Co. had proposed raising rates by 52 percent and PacificSource by nearly 43 percent, with LifeWise and Health Republic not far behind.

State officials ultimately lowered some of those slightly, but in interviews, Cali said the high increases were necessary to ensure carriers remained solvent. That’s to maintain competition in Oregon’s market and avoid the shock of carriers folding midyear, which creates a mess for consumers. Moda nearly left the individual market a few months ago before working out an agreement with the state to stay in operation.

Nonetheless, Oregonians will have fewer choices next year. Health Republic and LifeWise will no longer sell policies.

O’Brien, of OSPIRG, said the market is indeed less competitive, but it’s far from having monopoly pricing from dominant players.

Carriers last year reported losing millions of dollars on customers who purchased policies in 2014. The new enrollees, many of whom could not purchase policies in the past because of pre-existing conditions, turned out to require far more medical care than insurers had predicted.

Now that insurers can’t manage risk by denying coverage to sick people, they should be working to lower the overall cost of health care by encouraging their customers to seek more preventive care, O’Brien said.

“It seems like that isn’t really working so far,” he said.

On the flip side, hospitals are benefiting greatly from Affordable Care Act rules, especially with the expansion of Medicaid dramatically lowering their levels of unpaid care. O’Brien said he thinks the focus now should be on health care providers lowering their prices.

“But that hasn’t happened yet, so I think we need to get serious about it and make sure that we can sustain this coverage expansion that we’ve seen,” he said.

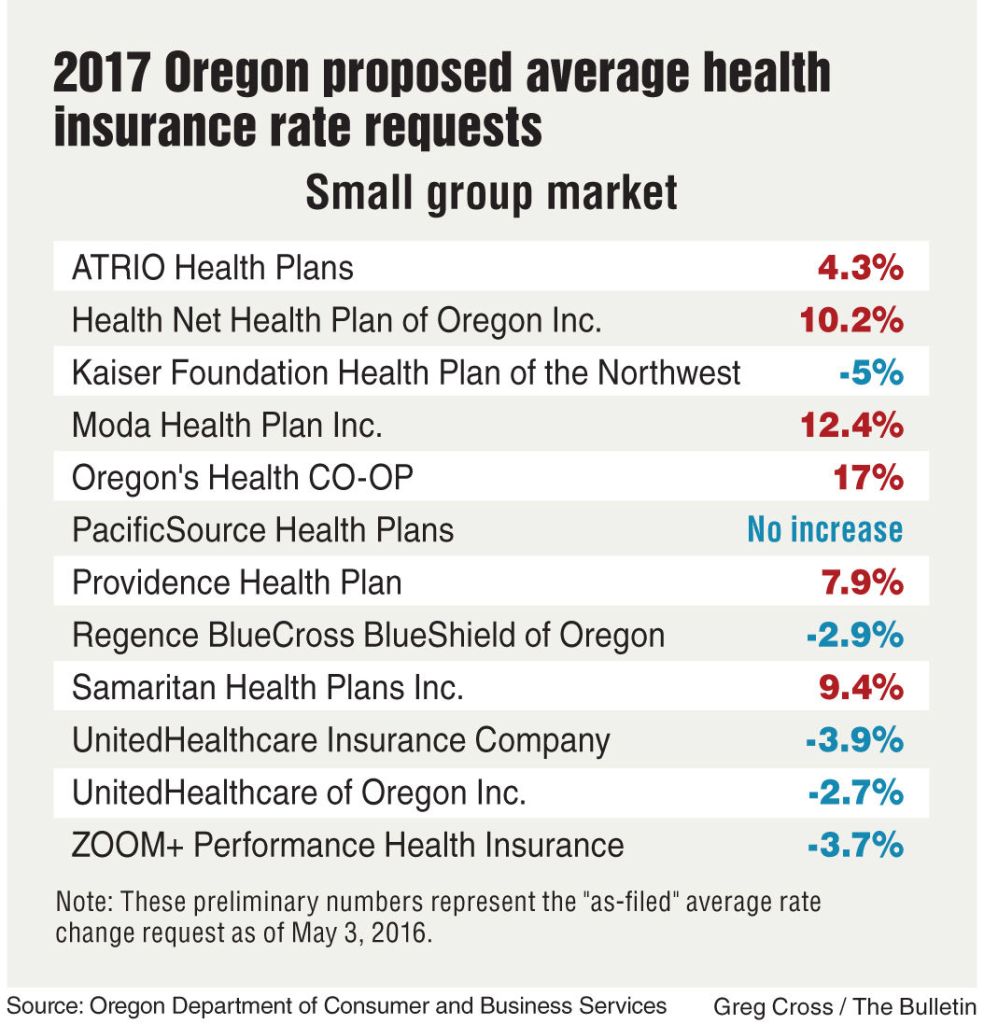

Oregon’s small group market, which includes businesses with two to 50 employees, has not seen the same dramatic rate increases as the individual market. In fact, five of the 12 small group carriers want to decrease their monthly premiums in 2017.

Kaiser Foundation Health Plan of the Northwest seeks the biggest drop: 5 percent. Oregon’s Health CO-OP seeks the largest increase: 17 percent. About 158,000 Oregonians had small group policies at the end of 2015.

O’Brien, whose organization acts as a consumer advocate during the rate review process, encourages Oregonians to submit comments on the proposed rates.

“The regulators really do pay attention to those comments,” he said, “and I think the more we can get people engaged with this process, the better it will be.”