Oregon will join free IRS tax prep, filing program next year

Published 11:00 am Thursday, June 20, 2024

SALEM — Some Oregon taxpayers will be able to prepare and file their federal tax returns for free directly to the IRS starting next year, an Oregon Department of Revenue spokesperson said.

The IRS Direct File program, a government-funded alternative to TurboTax and other online tax services, will allow taxpayers to calculate and submit their federal tax returns directly to the IRS. Robin Maxey, an Oregon Department of Revenue representative, said in an email the system will connect with Oregon’s existing free state tax filing system, Direct File Oregon.

Maxey said nearly 7,000 people in Oregon used the state’s service in 2024. Once an Oregon taxpayer completes their federal return through IRS Direct File, Maxey said the IRS will link them to Direct File Oregon.

He said taxpayers who don’t qualify for IRS Direct File will still be able to use the state’s system. Both services can be accessed on desktop or mobile devices.

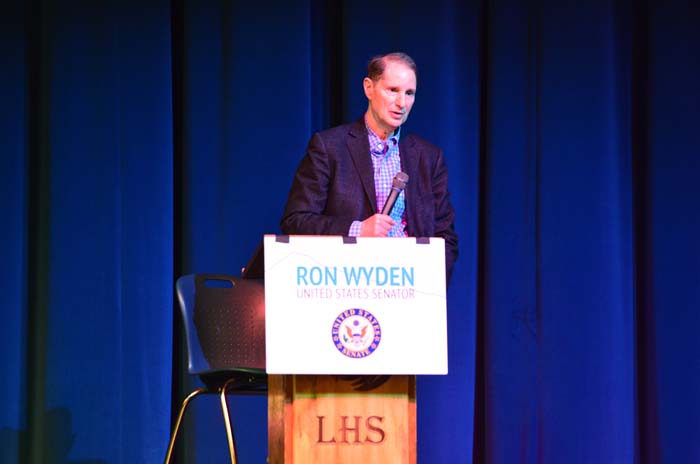

Sen. Ron Wyden, D-Oregon, and U.S. Treasury Secretary Janet Yellen lauded the expansion on a press call Tuesday, June 18.

Wyden said Direct File will decrease costs for taxpayers who have traditionally filed their taxes through commercial companies such as Intuit, the maker of TurboTax software, or H&R Block’s online tax prep. The IRS previously said its program saved those people about $5.6 million in fees they would have spent if they filed their taxes through those companies.

“I believe the IRS has built a good tool that people are going to like because it saves time, headaches and money,” Wyden said. “No surprise, then, that the people who oppose this are acting as if Direct File will bring on the end of Western civilization.”

Commercial tax filing companies had for years resisted an official alternative by committing to free services for low-income filers. An Intuit spokesperson said in a statement the system constitutes unnecessary government spending for a free program.

“The decision to expand Direct File doesn’t change the fact that this program is a solution in search of a problem and every American can already file their taxes for free, without any cost to the government or taxpayers,” the statement read.

The IRS rolled out Direct File in the 2024 tax season as a test, with only a dozen states participating. The agency reported earlier this year that almost 150,000 people had filed their taxes through the system in its limited rollout. Oregon will be the first new state to join Direct File for next year’s tax filing season.

Direct File was only available to people with income coming from simple wages, social security or unemployment insurance. Income such as capital gains, money from payment apps or gig work couldn’t be submitted through the system.

A treasury administrative official, however, said the IRS would expand those income requirements. They said the goal is to cover the most common tax situations, especially those affecting working families over the coming years.

Users in the pilot program could also only submit a standard deduction — the system did not allow for itemized deductions.

The IRS said its program saved those people about $5.6 million in fees they would have spent if they filed their taxes through commercial companies such as Intuit, the maker of TurboTax software, or H&R Block’s online tax prep.

However, advocates say the system could help more people access tax credits they otherwise wouldn’t have claimed by reducing the complexity of tax returns. IRS Direct File, in its rollout, allowed eligible filers to claim the child tax credit, earned income tax credit and credits for dependents.

IRS data from 2013 to 2020 shows that Oregon consistently ranked toward the bottom nationally in the percentage of families redeeming the earned income tax credit, designed to help reduce poverty. In 2020, Oregon ranked last nationwide with less than 70% of families redeeming the credit.